Govt must move beyond subisidies

KUALA LUMPUR: The government has to move beyond its subsidy-based system and devise measures to provide a living wage if it intends to effectively address the rising cost of living issue in the long term.

The living wage system, say economists, should transcend mere definitions of below or above the poverty line, and delve deeper into what Malaysians need based on a wide range of factors.

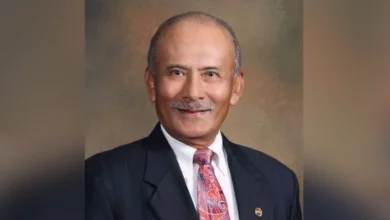

Professor Tan Sri Dr Noor Azlan Ghazali, who is the Malaysian Inclusive Development and Advancement Institute-Universiti Kebangsaan Malaysia director, defined a living wage as “a level of income that enables an individual, as well as his or her family to lead a comfortable life”.

The government, he said, should set the living wage based where a person lived, irrespective of whether the household income was below or above the poverty line.

“According to the World Bank, Malaysia is a step away from becoming a high-income nation but we need to shift towards looking into the quality of living as reflected by the living wage. This is what the government must do and not just use one-liner solutions to assist the people.”

Noor Azlan said the Finance Ministry must improve its strategy based on the data available from the Department of Statistics Malaysia (DOSM) to target locations in need of improvement.

He said, for example, someone earning RM5,000 a month and living in Johor Baru, Johor, may incur more in terms of monthly expenses and needed special assistance compared with someone earning the same amount but was residing in Jerantut, Pahang.

Noor Azlan said while elevating people beyond the poverty line “sounds better” from an economic point of view, it did not necessarily mean that those who did not receive financial aid had a better quality of life.

“Currently, the B40 group earns an average of RM4,850 (and below) a month. This, however, isn’t a decent enough wage if the person lives in the city since the majority of their income goes to daily expenses such as food and necessities.

“A person will need at least RM6,200 per month for a decent living. This will allow them to bring their families out to dinner and have enough left for leisure activities at the end of the month instead of living week to week.”

While he commended the government’s efforts in providing cash aid for the people to weather the economic situation, Noor Azlan, however, cautioned that the cash aid must reach the target groups that really needed the assistance.

“The government must find better ways to help single people secure a better income, not just with a RM50 cash aid. It must be effective and efficient in helping people and do it right.

“Post-Covid-19 pandemic, we have been spending a lot. I think the authorities are concerned about the country’s limited fiscal space. This is something that needs to be deliberated on. I doubt that the government can sustain and continue to provide cash aid programmes as an immediate solution to mitigate this problem.”

Noor Azlan also explained the difference between inflation and cost of living to clear the confusion about the two elements.

“The (average) 2.8 per cent inflation rate as reported by Bank Negara Malaysia means a single number for the whole country. But there is a lot more, so imagine there are other components (under inflation) such as food, transport, utilities and 15 other groupings of things.”

Noor Azlan cited food as one of the inflation sub-categories. He noted that the food inflation sub-category was 5.1 per cent higher than than the average inflation rate of 2.8 per cent.

He said DOSM’s report showed that food alone had recorded an increase in prices.

“As such, 93 per cent of items in a food basket have reported a surge in prices.

“For the low-income group, 37 per cent of their expenditure is on food.

“What I am trying to clarify here in terms of inflation is that while some may say we don’t have a problem, when you look closely, we are facing (several) issues.”

Noor Azlan explained that cost of living involved incomes and prices.

“The increase in prices is tolerable if income increases at the same rate or better. However, we are facing a double-whammy here as the country is facing the effects of the post-Covid-19 pandemic with about 3.1 million people having experienced a drop in income.”

Echoing Noor Azlan’s view is UniKL Business School Associate Professor Aimi Zulhazmi Rashid, who says a long-term economic plan is imperative.

Aimi Zulhazmi, however, conceded that it could not be done overnight. He said factors such as the presence of established cartels, which have dominated the supply chains for decades, could be among the biggest obstacles.

“With subsidies, the expenditure is expected to breach RM77 billion for 2022. A long-term strategy beyond mere subsidies and the abolishment of import permits must be developed and implemented progressively.”

He suggested empowering government-linked companies and government-linked investment companies to create a better-controlled supply chain of food items.

“Malaysia’s success in palm oil plantations and rubber plantations are well known globally. However, commercial plantations have dominated agricultural lands by a ratio of one to five compared with food plantations like rice, vegetables, spices.”

Aimi Zulhazmi said Malaysia’s inflation rate was measured by the change in the Consumer Price Index (CPI), which is the average rate of increase in the price of a basket of goods and services.

These, he said, were mostly exemplified by fuel and food items.

“On the other hand, cost of living refers to the amount of expenditure on goods and services incurred by households, including their financial obligations to maintain a certain standard of living, which differs according to household segments.”

Aimi Zulhazmi said cost of living was also determined by household spending patterns and the prices of goods.

“Spending patterns differ across households as the patterns are primarily influenced by household income, demography, family structure and area of residence.”

Economist Nungsari Ahmad Radhi said direct cash transfers could be effective in mitigating inflationary effects, especially on low-income households and vulnerable groups.

“The government’s fiscal situation is very challenging and it doesn’t have the resources to do that without radically changing the way the government manages fiscal policy.

“One painful thing that must be done is subsidy rationalisation, which the government is already initiating.”

Nungsari said at least 40 per cent of the items in the CPI contained price-controlled goods.

“The government subsidises the cost of those items and controls their prices, therefore showing a moderate CPI or price increase than what it actually is.

“For example, cooking oil is a controlled item.

“There’s a ceiling price and the government subsidises producers if costs go above the ceiling price. The inflation in CPI is almost fixed zero inflation.

“Now, all subsidies for cooking oil have been removed except for the 1kg oil packets. So the prices of all other cooking oil will be increased to match the market prices.

“How will the inflation for cooking oil be measured in CPI?

“If cooking oil prices go up, everything related to it will go up too.”

Nungsari said the people’s purchasing power would decrease when their income did not rise as quickly as the cost of living.

The inflation rate, he said, was trending at 2.8 per cent in May from 2.3 per cent in April.

“However, this is due to the presence of subsidies and price control measures, which accounted for about 19 per cent of the total Cost Per Unit weightings.

“To some degree, the central bank would help to control inflation via monetary policy if demand-pulled inflation becomes evident.

“So raising the overnight policy rate (OPR) is also part of ensuring that inflation remains under control.”

NST