Jho Low used fiduciary fund firms to obscure transactions, High Court told

KUALA LUMPUR: A former Singaporean banker today explained to the High Court how fugitive businessman Low Taek Jho, better known as Jho Low, used fiduciary fund companies to give the optical illusion that funds belonging to 1Malaysia Development Bhd (1MDB) were invested in bona fide investment instruments.

Kevin Michael Swampillai, a former representative and head of the Wealth Management Services Department of BSI Bank Ltd’s Singapore Branch, said the initial use of fiduciary fund structures in 2011 by SRC International Sdn Bhd had set the standard for all subsequent transactions conducted by 1MDB.

He said some of the fiduciary fund firms included Cistenique Investment Fund, Enterprise Emerging Market Fund, Devonshire Capital Growth Fund and Bridge Absolute Return Fund.

He said these were all companies on the BSI Bank panel of fiduciary fund solutions, which were made available to all clients of the bank seeking such solutions, which included 1MDB, 1MDB Global Investment Ltd (1MDBGIL) and SRC International.

“In the case of the 1MDB fiduciary fund firms, monies transferred to these companies were not placed on deposit, rather they were conduits to channel monies to various beneficiaries known only to the clients themselves, while at the same time obscuring the intentions of the client from scrutiny by various stakeholders in Malaysia.

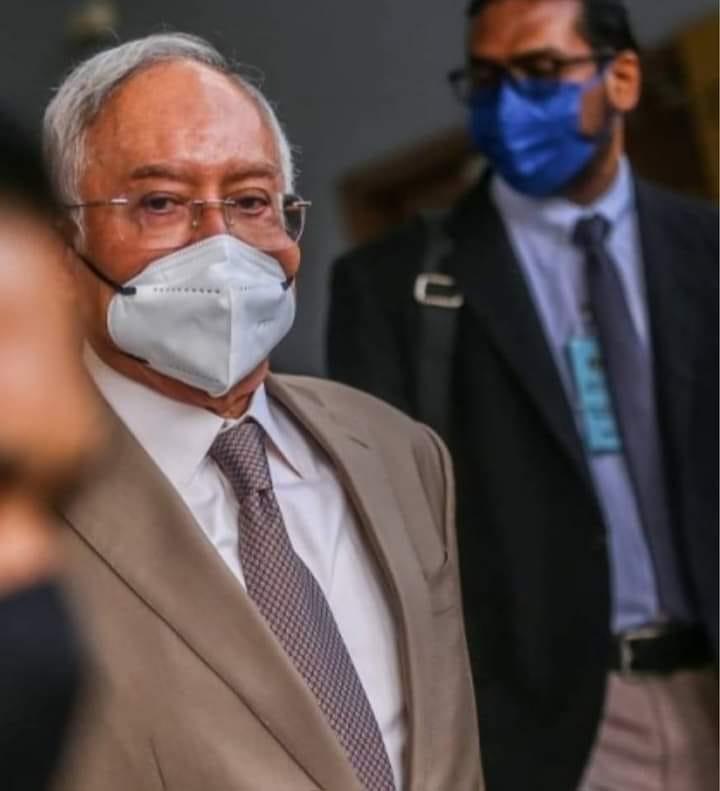

“I was always under the impression that these transactions were undertaken with the knowledge of the then prime minister Datuk Seri Najib Razak as he was the chairman of the 1MDB Board of Advisers.

“The size of these transactions was of such a high magnitude and frequency that they had to have some kind of apex approval, such as that issued by a highly placed government official, like a prime minister.

“Low’s various intimations to BSI Bank was that he was an adviser to Najib, which was communicated to me by my superiors and the relationship manager, Yak Yew Chee.”

Swampillai said this when testifying as the 44th prosecution witness in Najib’s corruption trial for money laundering and misappropriation of RM2.3 billion belonging to 1MDB.

He said there was always great haste demonstrated by the clients (1MDB and its entities) to invest the money in fiduciary fund firms as quickly as possible.

“I was not surprised to learn that a significant number of fiduciary fund transactions occurred within one day of 1MDBGIL receiving about US$2.721 billion in its account at BSI Bank.

“I had observed in previous transactions involving other 1MDB-related clients that cash do not tend to stay in their accounts for very long.

“Our employees were put under immense pressure by the clients to hasten the process of transferring the monies from 1MDBGIL (and other 1MDB-related client accounts) to the fiduciary fund accounts, and subsequently to the account of the target company.”

He said the bank employees were also reminded that they were handling highly sensitive and time-bound transactions involving the sovereign wealth fund belonging to the Malaysian government and complacency would not be tolerated.

Najib, 70, is facing four charges of using his position to obtain bribes totalling RM2.3 billion from 1MDB funds and 21 charges of money laundering involving the same amount.

The trial before judge Datuk Collin Lawrence Sequerah continues.

NST