RM167.39 Billion Flowed From Hong Kong To Singapore

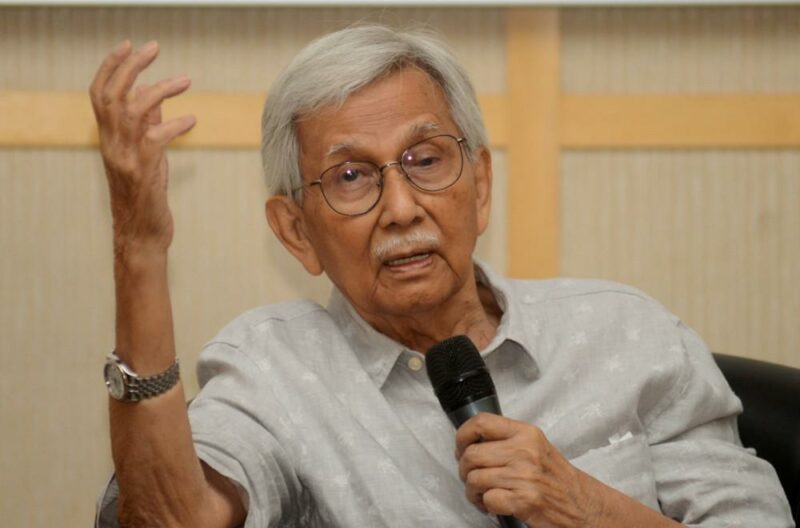

How Tun Daim Use Singapore To Store Money Offshore

By – Editor

When most boys boast ownership of gadgets and toys, Daim Zainudddin’s youngest sons became owners of a British Virgin Islands (BVI) firm by the ages of nine and 12.

Muhammed Amir Zainuddin Daim and Muhammed Amin Zainuddin Daim, born in 1995 and 1998 respectively, became shareholders of Newton Invest & Finance Limited (BVI) in 2007, which held properties in London worth £10 million at the time.

According to documents obtained by the International Consortium of Investigative Journalists (ICIJ) and sighted by Malaysiakini, they are joint shareholders with their mother, Naimah Abdul Khalid, who is the former finance minister’s third wife.

By 2017, when the brothers were in their early 20s, they were owners of several offshore firms set up in tax havens, including Splendid International Ltd (BVI) which held London properties worth £12 million (about RM65 million at 2017 exchange rates).

Newton Invest & Finance Limited (BVI) and Splendid International (BVI) were among a list of trusts and companies linked to Daim, which were incorporated in tax havens, revealed the Pandora Papers, a trove of documents obtained by the ICIJ and sighted by Malaysiakini.

An anonymous source shared with ICIJ 2.94 terabytes of confidential financial files, amounting to more than 11.9 million documents and other records, from 14 offshore service providers that set up and manage shell companies and trusts in tax havens around the globe.

Owning offshore accounts, companies or trusts, however, does not necessarily mean one is engaged in anything illegal, nor is it illegal to set up offshore entities.

Touted as the godfather of corporate Malaysia, who wields considerable influence in the political sphere, Daim has thus far not made it into the Forbes Malaysia’s 50 richest list.

This is perhaps because his business dealings have been largely a mystery, with corporate watchers occasionally picking up on some of his holdings by keeping a watch on activities involving his close family members or known business associates.

One of those associates is Josephine Premla Sevaretnam, a former lawyer and deputy public prosecutor, who served alongside Daim in the service before holding key positions in his various ventures.

This includes the Swiss bank ICB Banking Group, which Daim owned 74.4 percent, when it was listed on the London Alternative Investment Market in 2007.

Josephine’s name appears again in Newton Invest & Finance Limited (BVI) and Splendid International Ltd (BVI) as the business manager, based in Bryanston Square, London.

An 800-by-200-foot garden square in upmarket Marylebone, London, Bryanston Square is an address that appears multiple times in searches involving Daim’s children and property or company holdings in London.

For instance, his Swiss-based British daughter Aslinda Daim-Pan, who took on her husband’s surname, is director of the British company 8 Bryanston Square Freehold Limited, according to the UK’s Companies House. The “property management” firm, however, only has £5 in assets, according to its last filings.

A 1,500 square feet three-bedroom flat at Bryanston Square, London, sells for upwards of GBP3 million, property listings show

Besides the two BVI firms, the brothers, now in their early to mid-20s, and their mother are also shareholders in several other offshore companies which hold properties in London.

The documents sighted by Malaysiakini state that the firms were either investment companies or property management companies, with the properties earning a rental income and purchased through a loan from Barclays in Knightsbridge, London.

In the Pandora Papers alone, the companies and trusts held by Daim’s children, wife or known business associates jointly held assets worth at least £25 million (about RM141 million).

When contacted, Daim said all taxes had been fully paid in every jurisdiction where he does business and where income was earned.

He added that not all trusts linked to him in the Pandora Papers belong to him, some belong to his children, and he has no knowledge or control of them.

“I’ve retired from business for some time already, and trusts are part of estate planning,” he said.

Singapore, gateway to tax havens

Daim is just one of several rich and powerful Malaysians holding assets in tax havens like the BVI, Jersey (part of the Channel Islands of the British Isles) or the Cook Islands.

Others linked to offshore entities in these tax havens include Westport Holdings Bhd’s G Gnanalingam, who made it onto the Forbes billionaires list this year, with a net worth of US$1.7 billion (RM7.12 billion).

According to the Pandora Papers, Gnanalingam owns BVI firm Paisley Marketing Limited, which as of 2016 held assets worth US$2 million held by Standard Chartered Bank, Singapore.

When contacted, a representative of Westports told Malaysiakini the offshore company was legally set up using legitimate funds in 2008 to hold a life insurance policy and investments.

It was dissolved in 2020 after it was gifted to Gnanalingam’s daughter, Shaline, the representative said.

Tiong Ik King, the brother of timber and Chinese media tycoon Tiong Hiew King, is linked to the BVI-based Roxton Investments Ltd, with assets of US$20 million in 2017 (about RM86 million at exchange rates at the time).

A request for comment had been sent to Ik King.

G Gnanalingam and daughter, Shaline

One running theme between these offshore companies held by rich and powerful Malaysians is that Singapore was used as a gateway to shift assets to tax havens.

Holding property overseas or having offshore companies or accounts abroad is not illegal.

Nor are owners of offshore firms or trusts obliged to declare these firms or trusts to the Inland Revenue Board as on paper, all funds transferred to the offshore entities should have already been taxed.

In some instances, however, the practice of having offshore companies has been linked to tax evasion or avoidance. In other cases, it is an attempt to maintain secrecy for various reasons.

Some national leaders have faced political pressure after being revealed as owners of offshore companies or trusts, with Iceland’s prime minister Sigmundur Davíð Gunnlaugsson resigning after being exposed in the Panama Papers in 2016.

Industry experts told Malaysiakini that up to about a decade ago when financial loopholes were abound internationally, offshore accounts and companies were indeed used for tax evasion or avoidance. These days, it is harder.

“(Today) I will call it tax optimisation and wealth management (instead of tax evasion),” one tax consultant told the portal on condition of anonymity to avoid jeopardising his relationship with clients.

“The days of using offshore trusts and companies to easily evade paying tax are gone (because) many countries have improved regulations on money laundering and illegal money activities.

“Evading tax nowadays is a lot tougher than, let’s say, 10 years ago,” he said.

Why Singapore?

But how is Singapore a gateway to Caribbean tax havens, and why is it a popular route for Malaysia’s high net worth individuals wanting to move money out?

The answer to that lies in the corporate services companies which are a common thread between the high net worth Malaysians featured in the Pandora Papers.

The most commonly used Singapore-based companies in the Pandora Papers were Asiaciti Trust and Trident Trust, the latter of which has offices throughout the world.

The setup is fairly straightforward – a person can engage a corporate services company in Singapore and state their intention to set up a trust or company in a tax haven, and the company handles all the paperwork.

Incorporation documents and correspondence sighted by Malaysiakini showed that clients need only show proof of identity and residence, declare in a form the source of funding for the assets, complete other simple paperwork, plus fork out a small sum of several hundred US dollars to set up offshore entities.

There is also an annual fee to keep the firm active and maintain its accounts.

Besides going through normal procedures of setting up a company in a tax haven, the corporate services firm are obliged to conduct due diligence, among others, checking if the applicant is a politically exposed person or on any terrorism or wanted list.

They need to then file a series of paperwork for the offshore jurisdiction, and the offshore company is born.

Other due diligence conducted includes checking if taxes had already been paid on the funds transferred in the originating country.

In the case of Newton Invest & Finance Limited (BVI), Daim’s sons and wife were deemed not politically exposed.

When contacted by ICIJ, Trident Trust, which had a role in setting up Newton Invest & Finance Limited (BVI), said it cannot comment on individual clients.

“Trident Trust Group is a global provider of professional corporate, fund and trust administration services.

“Each of Trident’s trust and corporate services businesses is regulated in the jurisdiction in which it operates and is fully committed to compliance with all applicable regulations.

“Trident routinely cooperates with any competent authority which requests information,” it said.

Singapore in top five countries for funnelling riches to low-tax regimes

Checks found the trend not only existing among Malaysia’s rich and powerful but also across the region with high net individuals in countries like the Philippines and Thailand setting up offshore companies via Singapore.

Singapore is not usually the final destination of the assets because it does not provide an attractive tax and asset protection package as some Caribbean nations, the tax consultant told Malaysiakini.

“What Singapore (financial) companies can do is help create trusts in countries with better tax regimes,” he said.

And even though the money does not stay in Singapore, the management of the firms in the Caribbean fuels an industry in the little red dot.

Singapore was among the top five countries in the world for channelling funds to countries with low or no tax regimes

Research by the University of Amsterdam’s Corpnet research group in 2017 reported that Singapore was among the top five countries in the world for channelling funds to countries with low (or even no) tax regimes such as Luxembourg, Cyprus and Jersey as well as the Caribbean islands such as the British Virgin Islands, Bermuda and the Bahamas.

Singapore’s wealth management and corporate services are also preferred in the region for their expertise, said Wayne Soo, an accountant with a Singapore-based corporate services firm.

He said that the island nation also has various free-trade agreements with many countries, making it easier to provide such services.

“There are a lot of international financial institutions such as Citibank, Credit Suisse, which are based in Singapore. Together with the free trade agreements, this is advantageous to Singapore,” he added.

Tax consultants in Malaysia whose clients want to set up offshore entities may recommend Hong Kong, as well, but recent political turmoil there has made Singapore more appealing.

Soo said the market speculated that some US$40 billion (RM167.39 billion) flowed from Hong Kong to Singapore due to the turmoil, but this was never officially confirmed.

“With regard to Malaysia, in view of the recent political issues, I will not be surprised if there are additional flows from Malaysia and other destinations, as the Monetary Authority of Singapore (MAS) had mentioned last year in one of their media conferences,” he said.

How offshore trusts can help shroud assets

Besides owning offshore companies, Daim also set up several trusts in the BVI, Samoa and the Cook Islands through the Singapore corporate services firm Asiaciti Trust.

One of them is called ICB Financial Group Holdings Trust, likely after the Swiss Bank ICB Bank owned by Daim.

The beneficiaries are his five children – Asnida, 60, Aslinda, 47, Md Wira Dani, 43, Muhammad Amir Zainuddin, 26 and Muhammad Amin Zainuddin, 23. When it was set up in 2005, his youngest sons were aged 10 and 7.

ICB Financial Group Holdings Trust is believed to have been closed in 2010, according to Asiaciti Trust records sighted.

Advertising by Asiaciti Trust, one of the most popular service providers in Singapore for setting up offshore entities in tax havens

Secrecy is a top reason for setting up an offshore trust in places like the BVI, because details of the trust, including its assets and beneficiaries, are not listed, the tax consultant told Malaysiakini.

“However, this is not to say there is perfect confidentiality. This is not like movies. If a government can show proof that illegal activities are involved, they can request information on a trust.

“The country that the trust is based in will then determine whether to release the information. It does mean the information is not publicly or freely available,” he said.

Asset protection is also an attractive draw with most tax havens used to protect assets from seizures in instances of bankruptcy and divorce, the tax consultant said.

“However, this does not prevent seizure if it can be proven that assets in question are illegal or the result of fraud.

“A case must be lodged with the country where the trust is established. This can be a long drawn process.

“If the person sets up a trust in Malaysia, then the trust is subject to local laws and government pressure,” he added.

Whether or not Malaysian authorities make a request for disclosure or seizure also depends on knowing these assets exist.

When contacted, Daim maintains all his business dealings in every jurisdiction are legitimate, and he has accumulated wealth for more than 60 years since he started buying and selling in the 1960s.

Meanwhile, the MAS said it does not tolerate abuse of its financial system for illicit activities, and it has a robust system to detect abuse, money laundering and tax evasion.

“MAS will not hesitate to take regulatory and enforcement action against individuals and entities, regardless of nationality, if they have breached the laws and regulations administered by MAS.”

This includes issuing a fine of SG$1.1 million to Asiaciti Trust for breaching anti-money laundering and counter-financing of terrorism (AML/CFT) practices regulations in July 2020 – a penalty Asiaciti has paid in full, it said.

The Singapore Ministry of Finance and Inland Revenue Authority of Singapore (Iras) added that its tax regime is built to attract economic activities, but it does not condone abuse for tax avoidance.

“Singapore thrives on being a well-regulated financial centre with a strong rule of law that provides a wide range of value-adding financial services.

“We are committed to upholding international standards to combat cross-border tax evasion and money laundering,” the MOF and Iras spokespersons said.

Meanwhile, when contacted by ICIJ, Asiaciti Trust, the Singapore financial services firm, said it works with clients worldwide and is subject to strict regulation by authorities in every jurisdiction it operates.

“We maintain a strong compliance programme, and each of our offices has passed third-party audits for AML/CFT practices in recent years.

“However, no compliance programme is infallible – and when an issue is identified, we take the necessary steps with regard to the client engagement and make the appropriate notifications to regulatory agencies,” it said.

Source – KRITIK MY & The Coverage – 30/12/2023