115 mangsa banjir selamat pindah, terima bantuan

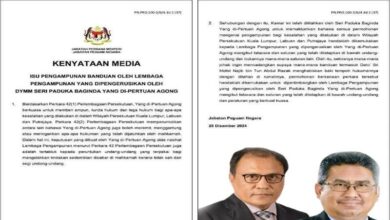

Menteri Besar Johor, Datuk Onn Hafiz Ghazi (kanan) dan Ahli Parlimen Parit Sulong, Datuk Seri Dr. Noraini Ahmad melawat serta menyampaikan bantuan kepada mangsa banjir sekitar Batu Pahat di beberapa pusat pemindahan sementara (PPS).

Oleh Azrin Muhammad

BATU PAHAT – Seramai 115 mangsa daripada 34 keluarga yang terlibat dengan kejadian banjir kilat sekitar kawasan Batu Pahat berjaya dipindahkan ke pusat pemindahan sementara (PPS) ekoran hujan lebat bermula pada 6.30 pagi, kelmarin.

Ahli Parlimen Parit Sulong, Datuk Seri Dr. Noraini Ahmad berkata, kesemua mangsa telah dipindahkan ke PPS Sekolah Agama Sri Bengkal dan Sekolah Kebangsaan Bintang Peserai.

“Saya mewakili Parlimen Parit Sulong mengucapkan terima kasih kepada anak-anak mahasiswa dari Yayasan Sukarelawan Siswa (YSS) yang turut sama membantu mangsa banjir,” katanya dalam satu kenyataan, di sini hari ini.

Turut hadir turun padang melawat mangsa dan memberi bantuan, Menteri Besar Johor, Datuk Onn Hafiz Ghazi.

Menurut Jawatankuasa Pengurusan Bencana Daerah (JPBD), seramai 194 mangsa daripada 59 keluarga masih ditempatkan di empat PPS melibatkan dua daerah di Batu Pahat dan Pontian sehingga 8 pagi tadi.

Antara kawasan terjejas ialah Kampung Seri Bengkal dan Kampung Bintang Peserai di Batu Pahat dan Kampung Sungai Mulih, Pekan Nenas; Kampung Parit Sapran; Kampung Parit Haji Omar; Jln Mohsin, Kayu Ara Pasong; Kampung Parit Haji Siraj; Parit Lapis, Kayu Ara Pasong serta Kampung Parit Abdul Rahman di Pontian.