Clicking on ‘bank loan’ advert leaves businessman RM6,300 poorer

Clicking on ‘bank loan’ advert leaves businessman RM6,300 poorer

IPOH: A businessman here planning to take out a loan ended up losing RM6,300 to an online scam.

Giving his name only as Azwan, 52, the man said he came across an advertisement, purportedly by a bank, on Facebook on March 2 and clicked on the link.

“I then received a call via WhatsApp from one Mohd Daniel, who introduced himself as a loan officer from the bank.

“I was offered a RM30,000 loan and needed to pay RM350 as stamping fee.

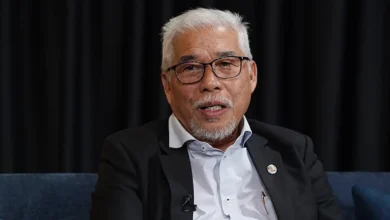

“I was instructed to deposit the money into a bank account belonging to an individual,” he told a press conference called by Perak Barisan Nasional public service and complaints centre chief Mohd Rawi Abdullah here on Friday (March 15).

DISYORKAN UNTUK ANDA :

- Ahli Parlimen PAS Yang Menjengkelkan

- AMK Berikan Peringatan Kepada Kepimpinan Utama PKR

- PAS panik, Faktor PRU15 tidak ada pada PRU16

Salam RM5 @ 1USD Realiti Atau Ilusi?

“I wanted to take out a loan for my business,” he added.

Azwan said the next day, he received a call from a different person who identified himself as Justin, also purportedly from the bank.

He was told the loan application had been approved, but he needed to deposit some money as a condition.

“I was told to bank RM3,000 into an account belonging to another individual.

“Shortly after depositing the money, I got a call from Justin again. He said they required another RM3,000 to meet the conditions,” he said.

DISYORKAN UNTUK ANDA :

- Pelaburan Asing Bukan Alasan Untuk Gadaikan Kedaulatan Negara Kepada China

- Dakwa Cuba Di Rasuah, Wan Saiful Tidak Di Lindungi Imuniti Ahli Parlimen

Gelombang Perpindahan Ahli PPBM, Kenapa PAS Tidak Menjadi Pilihan?

“I did not hesitate to bank the money again to the same account.

“The man called again but this time asked for RM4,100 more as proof that I can pay the loan instalments. It was then I knew that I had been scammed,” he added.

Azwan said he lodged a police report on March 5.

“It was my mistake for not checking with my friends and family first. I know I cannot get my money back and could have lost even more.

“I want to urge the public to be careful and always check with banks to ensure the advertisements are real,” he added.

Mohd Rawi said it was hard to tell if some of the advertisements on social media platforms were genuine or fake.

“I think it is safer to just go to the banks directly for loans even if it seems easier to apply online,” he said.

Clicking on ‘bank loan’ advert leaves businessman RM6,300 poorer

DISYORKAN UNTUK ANDA :

- PAS Cuba Pujuk Amanah Supaya Tinggalkan DAP

- Parti Amanah pun tidak mahu bersama PAS

- PAS Dan Gerakan Berbalah Lagi, Muhyiddin Buat Tak Reti

LAWATI LAMAN FACEBOOK KAMI :